Adani acquires stake in NDTV: Will retail investors benefit?

Adani acquires stake in NDTV: Will retail investors benefit?

The proposed NDTV's takeover by Adani Group marks Gautam Adani's second media bet in 2022. While the acquisition seems to be 'hostile', it is the retail investors that stand to win. Here is a report

Puneet Wadhwa New Delhi

)

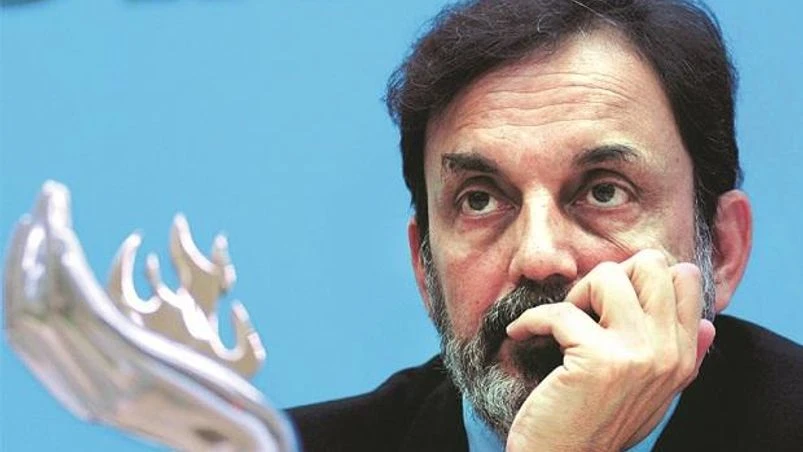

NDTV, in a statement, said Radhika and Prannoy Roy (pictured) believed the Sebi order was based on an incorrect assessment of the situation and a “highly unusual and perverse directive”

Putting an end to months of speculations, billionaire Gautam Adani’s media division officially sought control of New Delhi Television or NDTV, on Tuesday.

Adani Group said it had used financial rights to purchase a 29.18% stake in NDTV, through the conversion of loans into an equity stake in the promoter group.

It further laid out plans for a subsequent open offer for a stake of another 26% at Rs 294 per share, valued at Rs 493 crore.

On its part, NDTV said its founder-promoters had not consented to the exercise of rights.

Analysts said, prima facie, the takeover appears to be a ‘hostile’ one, and that the battle of ownership could be a long drawn affair.

Thus, they believe the camp that stands to gain the most is that of retail investors.

According to AK Prabhakar of IDBI Capital, “In NDTV's case, the retail shareholders stand to gain if the stock price continues to move up. Those who bought the stock at a much lower rate will be better off selling them in the secondary market rather than tendering them via the open offer” – AK Prabhakar, Head of Research, IDBI Capital

On the bourses, shares of NDTV hit the 5% upper circuit on Wednesday, hitting a 14-year high of RS 384.50 on the BSE.

More From This Section

In the past three months, the stock has zoomed nearly 140%, as compared to 8% rise in the S&P BSE Sensex. Moreover, over the past one year, it has soared 382% as against 6% gain in the benchmark index.

That said, independent market analyst Ambareesh Baliga says there is a surprise element in the entire development.

Speaking to Business Standard, Baliga says, VCPL was bought at Rs 114 cr. The value of the warrants, however, was close to Rs 800 cr. Public shareholders will not tender shares at a discount. Fund that holds close to 9.75% stake in NDTV could tilt the balance. Public/retail shareholders to benefit the most if the stock gains

As per technical charts, NDTV shares can move up another 15% upside and may hit 450 rupees-mark in the near-term.

On Thursday, the monthly F&O expiry for August series will drive the markets. Besides, crude oil prices and investors’ anticipation of Fed chair Jerome Powell’s address at Jackson Hole will be eyed.

Also Read

Topics :NDTVGautam AdaniInvestors

Don't miss the most important news and views of the day. Get them on our Telegram channel

First Published: Aug 25 2022 | 7:00 AM IST