Market Ahead Podcast, April 23: Top factors that could guide markets today

Market Ahead Podcast, April 23: Top factors that could guide markets today

Amid rising cases, rating agency Fitch Ratings has affirmed India's long-term foreign-currency Issuer Default Rating (IDR) at 'BBB-' with a negative outlook

BS Web Team New Delhi

)

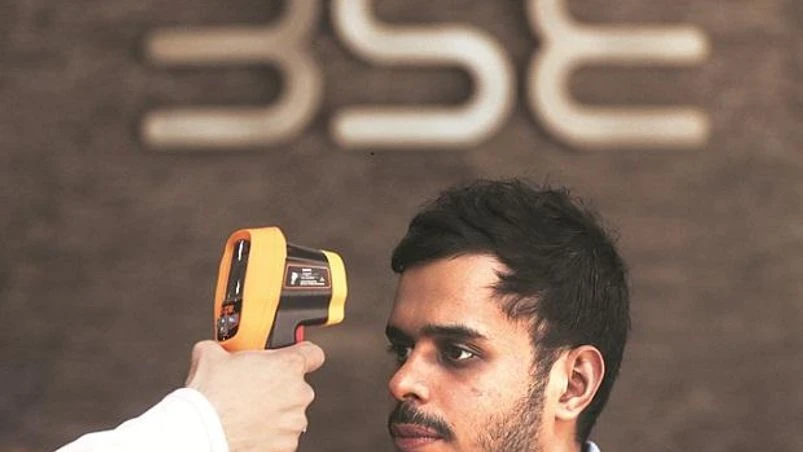

Weak cues from Wall Street, a spike in Covid cases and rating agency action are among factors that are likely to keep Dalal Street bulls under pressure today. At 7.35 am, SGX Nifty was ruling 55 points lower at 14,348, indicating a tepid start for the benchmark indices.

India added more than 3.3 lakh cases in the last 24 hours, making it the second consecutive day when it added over three lakh new cases and a new record for any country in the world. If cases continue to grow at this rate then India could add about a million cases in three days and this could put further pressure on the stock markets.

Amid rising cases, rating agency Fitch Ratings has affirmed India’s long-term foreign-currency Issuer Default Rating (IDR) at ‘BBB-’ with a negative outlook. The negative outlook reflects lingering uncertainty around the debt trajectory, following the sharp deterioration in India’s public finance metrics because of the pandemic, Fitch said.

That apart, Covid cases also dominated the MPC deliberations, shows minutes, with many worrying that economic recovery could stall leading to the status quo on rates and accommodative monetary stance. Rapidly rising cases of COVID-19 is the single biggest challenge to the ongoing recovery in the Indian economy, RBI Governor Shaktikanta Das said, as per the minutes of the meeting.

Also Read

Meanwhile, on the global market front, U.S. stocks dived on Thursday on reports President Joe Biden planned to almost double the capital gains tax. The Dow Jones Industrial Average fell 0.94%, the S&P 500 lost 0.92% and the Nasdaq Composite dropped 0.94%.

The sombre mood was visible in Asian markets too with Japan's Nikkie trading 0.76% down. Meanwhile, South Korea's Kospi was flat, up 0.02% and Australia's S&P/ASX 200 shed 0.04%.

Now, a look at the stock-specific triggers that are likely to guide the market today

HCL Tech, IB Realty, M&M Financial Services are among 16 firms slated to post their March quarter numbers today.

Analysts expect HCL Tech's March quarter PAT to fall between 26-31% on account of one-time bonus impact although they eye a growth in the revenue, led by contribution from DWS Limited - a leading Australian IT, business and management consulting firm that HCL Tech acquired recently - demand in areas of digital foundation projects and improving traction in ER&D segment.

Shares of Future Retail and Future Enterprises will be in focus today after a BS report stated that lenders to Kishore Biyani's Future Group will withdraw the just-approved debt recast plan that offered easier repayment options, if the troubled retailer's Rs 24,713 crore asset sale to Reliance Industries Ltd (RIL) goes through in a reasonable time frame.

Rallis India Thursday reported a consolidated profit after tax (after exceptional items) of Rs 8.12 crore for the March quarter. The company's consolidated PAT stood at Rs 68 lakh during the corresponding period of 2019-20.

Torrent Power said it will set up a 300 MW capacity solar power plant in Gujarat at an estimated cost of Rs 1,250 crore.

More From This Section

Topics :Market AheadMarkets

Don't miss the most important news and views of the day. Get them on our Telegram channel

First Published: Apr 23 2021 | 8:08 AM IST